Without giving you any BS i'll

dive right into the content. Building wealth requires patience and

determination and a never ending thirst for success. If you think you can

muster all these three characteristics to build a 'new you' i can guarantee

that you will be successful at building your wealth.

Complete financial

independence can only be achieved gradually. It cannot happen in one day or one

year. What is the starting point of financial independence? The starting point

is to realize that something like a ‘wealth formula’ exists. In this article we

will get introduced to this wealth formula

How to realize ones

dependency on paycheck

It is not so difficult. The realization can be

achieved easily by doing a small experiment. Take a conscious decision of not

using one months salary. That month, use only savings to pay for all expenses.

Repeat this experiment for at least two months.

The longer one can survive without using paycheck,

the better. A completely financially independent person will survive all his

life without a paycheque. But for us, we will have to experiment it for only 60

days. The closer to 60 days one can get, the more likely he/she will achieve

financial independence in life. How? People who has a habit of saving and

investing money can only achieve financial freedom.

Majority cannot pass the first 10 days of the

month. Its true that this experiment will make you very uncomfortable. But once

you come out of it, you will be a changed person.

You will start asking difficult questions to

yourself. What happens if I loose my job? How will my child continue education?

How will I pay my EMI’s? This realization about how dependent we are on salary,

is one big step towards building wealth. Everything after that will start

happening automatically.

Asset-Liability and

Wealth Building

Establishment of

financial goals in life is a must. Goals gives direction to our spending

habits. People spend money to buy assets. But more people spend money to

accumulate liabilities. If goal is to accumulate wealth for future education of

child, it is less likely that the fund get spend elsewhere (to buy a liability

like a car). In general we can say the goals helps us to buy more of asset and

less of liability.

For financial freedom,

one must buy more of assets and less of liability. But confusion exists between

what are assets and what are liabilities.

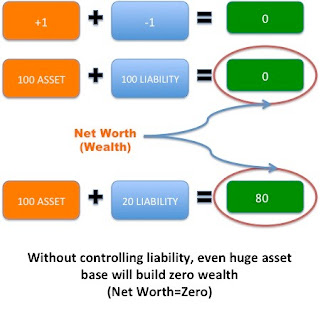

To know the difference

between asset and liability, we can use simple mathematics. We know that 1+1 =

2, & 1-1 = 0. Asset is +1 and Liability is -1. Our effort shall be to

accumulate more of +1’s. In parallel, we must also try to accumulate minimum of

-1’s. In the process of building wealth, important is to realize, which items

are +1 (asset) and which is -1 (liability).

Don’t Confuse Liability

with Asset

There is difference between asset and liability. Assets adds money to pocket.

Liabilities takes money out of pocket.

Asset accumulation does not mean buying a house, fast car etc.

Anything which generate net expense is a liability. Only thing which generates

net income is a asset.

Example of assets:

– Cash reserve in saving account.

– Dividend paying stocks.

– Dividend paying mutual funds.

– Value Blue Chip Stocks

– Zero debt rental property etc.

Ones financial goal

should be to accumulate such income generating assets.

Asset focused financial goal will eliminate confusion between

asset and liability. One such goal can be like “In next 10 years time I shall

be earning at least Rs 50,000 in form of dividend income from stocks”. Here,

dividend paying stock is an assets.

The concept of Return on

Investment

Dividend income from stocks is the return on investment. If one wants to build wealth,

‘assets’ and ‘return on investment (ROI)’ is the key.

ROI is a litmus test for any asset. It helps to differentiate

asset from liabilities. We consider many item as asset. But if it is not

generating ROI, it cannot be an asset. A combination of asset and ROI has potential to

build wealth over time.

Wealth

Formula # 2

How to Simply Build

Wealth

Accumulate assets and minimizing liabilities.

But if building wealth is so simple then why everybody is not a millionaire?

Accumulating assets is easier said than done. This is because, to

buy an asset one needs to compromise a liability purchase. Liability is like a

‘Cheese Burger’ which is very tempting and hard to resist. Asset is like a

‘Vegetable Soup’ whose benefit can be seen only in long term.

Majority gets tempted to buy liability before an asset. This is

what makes people poor. Selection of asset over liability can make people very

rich. But its not easy to fight ones own temptations.

Our education system has also not taught us the difference between

asset and liability. Instead, we got wrong examples of assets. In our endeavor

to master the wealth formula, we must also remember this:

Assets adds to net worth. Liability eats

away net worth

Starting Point of

Wealth Building…

A man was driving a luxury car on a highway. He was enjoying the

drive. But he had no destination. Ultimately he took a U-turn and head back

from where he started.

In the same way, building wealth cannot happen without clear goal.

In absence of goal there is 99% probability that one will not travel long.

Financial goal is like a compass that gives direction to person.

Identifying clear financial goals is the best starting point for wealth building.

Quantifying & scheduling

money-requirements further helps to build wealth.

A typical financial goals is shown in a below table. Please note

the last row. Creating a goal of becoming financially independent is essential.

Path to building substantial wealth passes through ‘achievement of

financial independence’. If one is not financially independent it means wealth

building has still long way to go.

Magic Formula to

Build Wealth

This is a magic

formula that can guide anybody build wealth.

This formula is a

result of excellent research work done by experts in the past. With the

introduction we already had here, lets use this magic formula for best results.

This is Wealth Formula 3

INJ = Income from Job

FI = Money required for Financial Independence

EX = Expenses

In order to understand this formula lets take an EXAMPLE 1:

INA (Income from Assets) = $0 / month

INJ (Income from Job) = $1,500 / month

FI (Money required for Financial Independence) =

$2,000/ month**

EX (Expenses) = $ 1,000/ month

Applying this on

Magic Formula:

$0 + $1,500 < 2,000 + 1,000

INA + INJ < FI + EX.

Income from asset (INA) is zero. Income from job (INJ) is $1,500 against

expense (Ex) of $1,000. But in order to become financially independent one

requires $2,000 each month which is unavailable. Hence person is not on right

way to become wealthy. Income from Asset (INA) must be increase to support

income from job (INJ). A stage must come where INA > EX. This is a condition

of financial independence.

EXAMPLE 2:

INA (Income from Assets) = $2,000 /

month [return on investment]

INJ (Income from Job) = $1,500 / month

FI (Money required for Financial Independence) =

$2,000/ month (money invested will strengthen INA)

EX (Expenses) = $ 1,000/ month

Applying this on

above formula of wealth:

$2,000 + $1,500 > 2,000 +

1,000

Income from asset (INA) is $2,000 against expense (EX) of $1,000. It means the person is financially independent. He is already making $1,000 more from Asset income, above EX. Hence the additional $1,000 goes to fund FI. As he is already financially independent, money diverted to FI is only making the person more and more wealthy.

Income from asset (INA) is $2,000 against expense (EX) of $1,000. It means the person is financially independent. He is already making $1,000 more from Asset income, above EX. Hence the additional $1,000 goes to fund FI. As he is already financially independent, money diverted to FI is only making the person more and more wealthy.

INA + INJ > FI +

EX